The proposal in this EIP is to start with a base fee amount which is adjusted up and down by the protocol based on how congested the network is. When the network exceeds the target per-block gas usage, the base fee increases slightly and when capacity is below the target, it decreases slightly. Because these base fee changes are constrained, the maximum difference in base fee from block to block is predictable. This then allows wallets to auto-set the gas fees for users in a highly reliable fashion.

- If not, the legacy gasPrice will be used as maxFeePerGas, which means that the user will potentially overpay for their transaction.

- Supporters of the PoS model say it will use less energy and better the blockchain’s efficiency.

- Legacy Ethereum transactions will still work and be included in blocks, but they will not benefit directly from the new pricing system.

- For more information about how EIP-1559 will change Ethereum, see here.

- See, the main motive of bringing EIP-1559 is to improve the system, give users a tremendous experience, and reduce the ether supply.

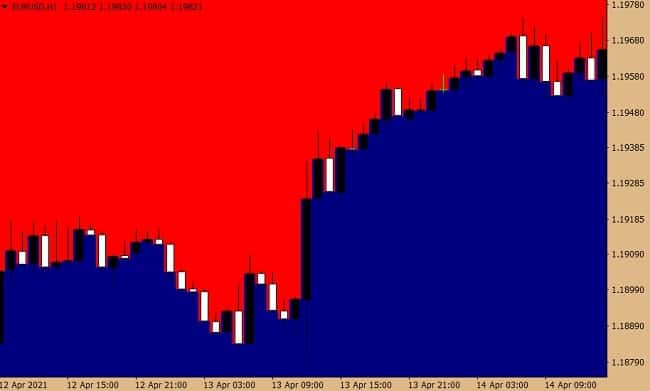

The burning of ETH as part of the base fee mechanism means that miner revenue is going to take a big hit, with the graphic below showing how the situation changes for miners. Effectively, the largest source of difference between information and data revenue for Ethereum miners (transaction fees) will disappear. However, the target block size will be set to 12.5 million gas and this mechanism will aim to keep blocks 50% full by adjusting the base fee.

Why Are Ethereum Gas Fees So High?

EIP-1559 is an “Ethereum Improvement Proposal” that involves burning a portion of the gas fees on Ethereum transactions. Right now, the DeFi market is one of the most innovative spaces in not just the decentralized world but the finance sector in general. EIP-1559 will address these problems and make the gas fees more manageable. This makes for a very unpredictable situation, in which the minimum gas price to get a transaction included changes all the time. EIP-1559 will continue to have an impact after Ethereum completes the switchover to proof of stake. That’s because its biggest contribution largely affects how fees are determined on Ethereum, not the network’s scalability in terms of the number of transactions it can manage.

What Is An Ethereum Improvement Proposal?

This coordinated “attack” will last 51 hours to signify their intent to capture more than 51% of the network hashrate. The purpose of this attack is to show the network what exactly could happen if the miners decide to gang up and work against Ethereum. Long-term, however, the proposal’s co-authors hope to make ether deflationary by reducing the supply. This would be “extremely beneficial” for investors, Conner says, especially “with all the recent talk of inflation in the United States.” It would give crypto investors an option to hold a deflationary asset.

Wrapped Bitcoin

There’s a belief that this move would effectively cut transaction costs by 90% and reduce the uncertainty over how much it would cost to transact on Ethereum. By switching to EIP-1559, that system will be replaced by a fee structure that is priced automatically by the network. On top of that, a tip system would be introduced to allow people who want their transactions verified faster, to pay a miner to do so. Despite growing awareness of MEV and potential EIPs to bring more transparency, we can expect arbitrage opportunities to only get more sophisticated as institutional financial traders use DeFi protocols. As an analogy to explain the base fee and tip, imagine the experience of using a ride sharing service app on your phone (e.g. Uber, Lyft, or Didi).

As the community prepares to see ETH become more scarce, many are eagerly anticipating the update. In this guide, we detail how it works, and what it could mean for Ethereum in the long term. In the previous system, all transaction fees were paid to the miners on the network. With EIP-1559, only the priority fee (and block rewards) go to the miners, while the base fee is burned. Think of Ethereum as a global, decentralized supercomputer, wherein developers from all over the world can rent out computational resources to execute their smart contracts and run dApps. Every single line of code requires these resources, aka gas, that’s siphoned from Ethereum’s mining network.

As such, contract execution requires one to pay gas fees to the miners in exchange for the computational power that’s being taken from them. It is possible that miners will mine empty blocks until such time as the base fee is very low and then proceed to mine half full blocks and revert to sorting transactions by the priority fee. While this attack is possible, it is not a particularly stable equilibrium as long as mining is decentralized. Any defector from this strategy will be more profitable than a miner participating in the attack for as long as the attack continues (even after the base fee reached 0). Since any miner can anonymously defect from a cartel, and there is no way to prove that a particular miner defected, the only feasible way to execute this attack would be to control 50% or more of hashing power.

While crypto veterans and DeFi Degens have learned how to navigate the current system, it’s not ideal for onboarding new users. Ethereum’s evolution is largely determined https://traderoom.info/ by submissions put forward by the community that maintains the network. The ongoing movement of applications to rollups and Layer 2s will be what greatly reduce fees.

By burning the base fee, we can no longer guarantee a fixed Ether supply. This could result in economic instability as the long term supply of ETH will no longer be constant over time. While a valid concern, it is difficult to quantify how much of an impact this will have.

This deflationary measure is important as Ethereum moves from Proof of Work to Proof-of-Stake, (POS). That’s because with POS, the cost to attack it is a function of how scarce the staking asset is. But it is a big deal for everyone else, and it also increases uncertainty as to the proper amount of gas required to send a transaction. It’s not easy, especially when bidding against an army of investors with deep pockets moving millions of tokens around to farm yield. Some mining pools disagree with the approach, and have even built tools stopping miners from using this technique. One of the biggest is SparkPool’s Taichi Network which prevents bots from spying on what transactions are currently in the queue.

To understand EIP-1559, we must first understand the reason for it to exist in the first place. Let’s first analyze some basic design components of Ethereum, starting with the transaction fee. It really has a lot of potential because its developers willingly put in their energy to implement new technologies and lead it to a better future. Especially the decreased supply, which is expected to make the Ethereum deflationary.

However, there could also be minor improvements or bug fixes that are submitted as EIPs that are adopted much quicker. When the Base Fee is burned, this is removing ETH from the circulating supply which makes it slightly more valuable and should help to raise the price. Under heavy loads of activity, there will be more ETH burned due to the Base Fee being higher and making it more scarce.

.jpeg)